Secure Your Escrow: Ensuring Safety in Online Real Estate Deals

The convenience of managing real estate transactions online has transformed the industry. Online escrow services (or at least the digital facilitation of traditional escrow) offer speed, efficiency, and accessibility. However, with any financial process conducted online, especially one involving significant sums of money, security must be the top priority.

How can you and your clients be sure these digital interactions are safe and that sensitive information isn’t falling into the wrong hands?

Understanding how online escrow services work, and what escrow security features to expect, is of utmost importance.

What to Expect from Secure Online Escrow Platforms

At its core, an escrow process involves a neutral third party (usually a title or escrow company) holding funds and documents until all contractual obligations are met. Online platforms digitize many elements of this process: communication, document sharing, transaction updates, and even, in some cases, financial instructions.

But this same digital convenience opens doors for potential fraud if not managed carefully. Below are the critical safeguards to demand from any online escrow service.

Key Escrow Security Features to Look For

- Secure, Centralized Portal

Instead of relying on scattered emails and attachments, a secure online portal—like the CloseSimple Portal—centralizes all communications and document sharing in one secure environment.

- End-to-End Encryption

Scattered emails and unsecured attachments increase risk. Instead, insist on a dedicated, encrypted portal that manages all communication and documentation in one secure environment.

- Trusted Branding

The portal and all communication should clearly display your trusted title or escrow company’s branding. Messages should come from your official domain, not a third party. CloseSimple’s white-labeled platform ensures everything originates from your name, reducing confusion and the risk of phishing.

- Multi-Factor Authentication (MFA)

Platforms should include authentication protocols like MFA to verify user identities and protect against unauthorized access.

- Secure Communication Channels for Wiring Instructions

Wiring instructions should only be shared within the secure portal, never over unverified email. CloseSimple’s fraud prevention tools protect this high-risk part of the process.

- Transparency

Users should be able to track the progress of the transaction and see what’s required from them at every stage.

How to Spot and Avoid Online Escrow Fraud

Fraudsters continue to get more sophisticated, but there are red flags you can watch for:

- Unexpected communications about your closing, especially ones that urge immediate action or ask for money transfers.

- Email addresses or URLs that look similar to trusted ones but include subtle changes or typos.

- Pressure tactics, like messages that create urgency or warn of consequences if action isn’t taken.

- Requests for login credentials, which legitimate title companies will never make via email or text.

- Unprofessional presentation, such as poor grammar or low-quality visuals, although some scams now appear polished.

If in doubt, don’t click. Instead, contact your escrow officer using known, trusted contact information.

How the CloseSimple Portal Secures Online Escrow Transactions

This is exactly where the CloseSimple Portal delivers unmatched value.

- One Branded, Secure Hub

The CloseSimple Portal provides a centralized, white-labeled platform that reflects your brand, ensuring all interactions are clearly identified as coming from your trusted title or escrow company.

- Eliminating Third-Party Confusion

Communications sent via CloseSimple come from your domain, not a vendor’s or a generic address. This reduces the risk of clients falling for phishing scams or being confused by third-party systems.

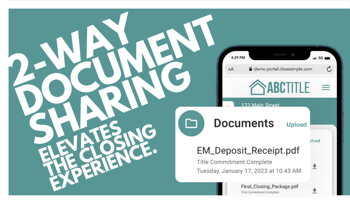

- Secure Document Exchange

Sensitive documents stay within the portal, encrypted and protected. No more risky email chains or lost attachments.

- Fraud Prevention Tools

Advanced tools like AI-powered ID verification, wiring instruction management, and more offer protection where it’s needed most.

- Client Transparency

Clients can log in to track real-time progress, securely submit documents, and stay informed without relying on email or phone calls.

Online Escrow Services That Deliver Real Escrow Security

While online escrow services bring undeniable convenience, their effectiveness hinges on strong escrow security protocols and transparent communication. That’s why platforms like CloseSimple go beyond functionality to deliver peace of mind. By providing a trusted, white-labeled environment, CloseSimple helps title and escrow professionals:

- Eliminate third-party confusion

- Reduce the risk of fraud

- Increase client confidence

- Maintain brand consistency from start to finish

The result? Transactions that are not only efficient but exceptionally safe.

Why Centralized, Branded Online Escrow Services Are Essential

When all digital interactions related to the escrow process are conducted within a secure, centralized, and clearly branded portal, title and escrow companies dramatically reduce the risk of phishing attacks and fraudulent fund requests that mimic third-party services. When clients interact through a portal that unmistakably comes from their title or escrow provider, it eliminates confusion and reinforces trust.

CloseSimple guarantees that every communication, update, and document exchange is fully branded and controlled by the title company—positioning your business as the single authoritative source of instruction. There’s no guesswork, no unverified third-party links, and no room for uncertainty.

Explore the CloseSimple Portal today to see the difference.

bogid - 27787114388

Related posts

The CloseSimple Portal

[Product Release] Introducing 2-Way Document Sharing for Title & Escrow

The CloseSimple Portal

[Product Release] Wiring Instruction Delivery

Resources

14 Images that Totally Capture a Title Agent’s Rollercoaster of Emotions on Closing Day

Resources

Best Title Company Software: Features, Security & Growth Integrations