Request & Receive Funds on One Secure Platform.

Now that's simple.

A Safer Way to Receive Funds

Securely request and receive earnest money and closing funds in the same company-branded portal your clients already trust.

Integrated Payment Solutions

CloseSimple’s Integrated Payments is your end-to-end solution for secure funds collection. By processing every Earnest Money and Cash to Close payment safely inside your portal, we eliminate vulnerable emailed wire instructions and the confusion of directing consumers to separate, third-party software.

Earnest Money Deposits

Cash to Close

Receive Earnest Money Deposits in Your Secure Portal

CloseSimple makes it easy to securely and seamlessly request and receive funds.

- Integrates with your title production software to eliminate separate logins and create a seamless workflow for your team.

- Provides a simple, secure, and branded portal for clients to submit payments, complete forms, and e-sign all in one place.

- Unifies payments, communication, and fraud prevention into a single, streamlined platform for everyone in the transaction.

Guarantee Your Closing Funds & Eliminate Wire Fraud

Stop relying on emailed wire instructions. CloseSimple’s new Cash to Close functionality ensures certified funds and guaranteed closing timelines by processing all payments securely inside your portal.

Fight fraud with one solution

CEO & Co-Founder Paul Stine explains the importance of integrating fraud solutions into our secure closing portal and how it benefits both title companies and consumers.

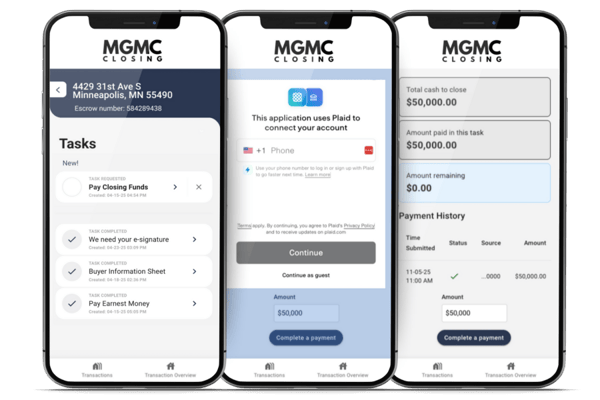

Now Your Clients Can Pay Closing Funds Directly Through Your Portal & Skip Wiring Funds

Step One: Request the Money

Initiate payment requests directly from your CloseSimple integration within your title production software. No duplicate entry, no insecure emails.

Step Two: Guide Your Client

Your client receives a branded, easy-to-follow notification to submit funds through the same secure portal they use for everything else.

Get Ready: How to Launch Early, Test & Learn

Hear from industry peers on how it's going and what they've learned as they've build and implemented process over the past few years.

What is FinCEN?

In 2024, the Financial Crimes Enforcement Network (FinCEN) introduced new reporting requirements under the Beneficial Ownership Information (BOI) Reporting Rule.

These rules affect real estate transactions—especially those involving legal entities—and require title and escrow companies to collect and report ownership data.