Being Powered by Service, Zappos Affect on the Title & Escrow Closing Process

Years ago, before Zappos was founded in 1999, no one would have considered buying shoes online.

Because how would you ever know if they fit?!

But Zappos dramatically changed the consumer experience and increased consumer trust. Zappos did something revolutionary that today seems quite ordinary: offering free returns.

When Zappos was created, it was a simple idea to allow consumers to purchase shoes online. The co-founders -- the most notable of which was Tony Heish -- had no idea if it would even work. In launching Zappos (to prove out his concept), Heish would go to shoe stores, take pictures of different shoes, and post those pictures on his website.

When someone ordered those shoes from his site, Heish would go back to the store, buy the shoes, and ship them to the customer. He wasn’t concerned with making a profit right away. His main concern was finding out whether consumers would be willing to buy shoes online. The reason the customers trusted Zappos was because if the shoes didn’t fit, they could ship them back at no extra charge.

In this series, we are talking about the QCCs -- things that go into creating a 6-star customer experience: quality, customer care, and customer control. Zappos is a great example of all 3 of these components, but in this post I want to focus on customer control because allowing a consumer to buy a pair of shoes, try them on, and ship them back for free means ultimate customer control. This concept forever changed e-commerce.

There’s a lot of positive things we could discuss about Zappos -- from their outstanding customer care (in one case, a Zappos employee had a 10-hour phone call with a customer) to the company culture with great staff training and how they’ve won multiple awards for customer experience. Today, though, we are focusing on how Zappos gave the customer ultimate control.

Customer Control

Zappos says they are “Powered by Service.”

… but what does that really mean?

Do you know anyone who has been on Zappos.com before and bought multiple pairs of shoes just to try them on and then returned all of them? It's definitely not uncommon. There is an aspect of control in the ability to order shoes or clothing, try them on, see how they fit and look on you, and return the items if you don’t love them.

This aspect of control is something that Zappos has tapped into better than even brick and mortar retailers. Why? Because Zappos allows the customer to do it on their own time and in the comfort of their own homes.

The consumer doesn’t have to drive to a store or worry about making it there between 10 am and 7 pm (I know that in the title and escrow industry, you sometimes work late and can’t make it to retail stores during their business hours).

Zappos is always open. And if the consumer doesn't like what they’ve tried on at home, they can ship it back at no cost.

Being “Powered by Service” Means Giving the Customer Total Control

When Tony Heish launched Zappos, he found that people were willing to try on shoes at home and ship them back if they didn't like them. He figured out something that no other online store had before: how to give customers ultimate control.

Had Heish and his team been more concerned with their bottom line (i.e., losing money if customers returned unwanted or misfitting shoes), Zappos might not have even half of the recognition that it has today.

By giving customers control over their online shopping experience, Zappos carved out a niche for itself in e-commerce. When thinking about buying shoes online, the first thought for most people is Zappos.

What Does This Mean for Your Title Company?

Customer control is important. Customers need to feel like they have a say in what’s happening.

They need to feel that in a commoditized industry -- such as shoes -- there is one company that works better for them than anyone else. The title industry sells a commodity: title insurance policies (of course, I know you know this). How does your title company stand out?

While there is not a one-to-one relationship between what Zappos offers (free returns) and what you might be able to offer with title policies and a closing day experience, what can you do to give your clients a little more control during the closing process?

If you follow the Zappos model, your title company makes sure that every question from your realtor and consumer is answered along the way, so that on the day of closing, the consumer is prepared and knows what to expect.

Zappos doesn’t force you to keep a pair of shoes that doesn’t fit. Does your title company do everything possible to ensure that on the day of closing, your consumer has a smooth and happy closing experience -- like having a pair of shoes that fit perfectly?

Making Closing Simple with Email Automation for Title

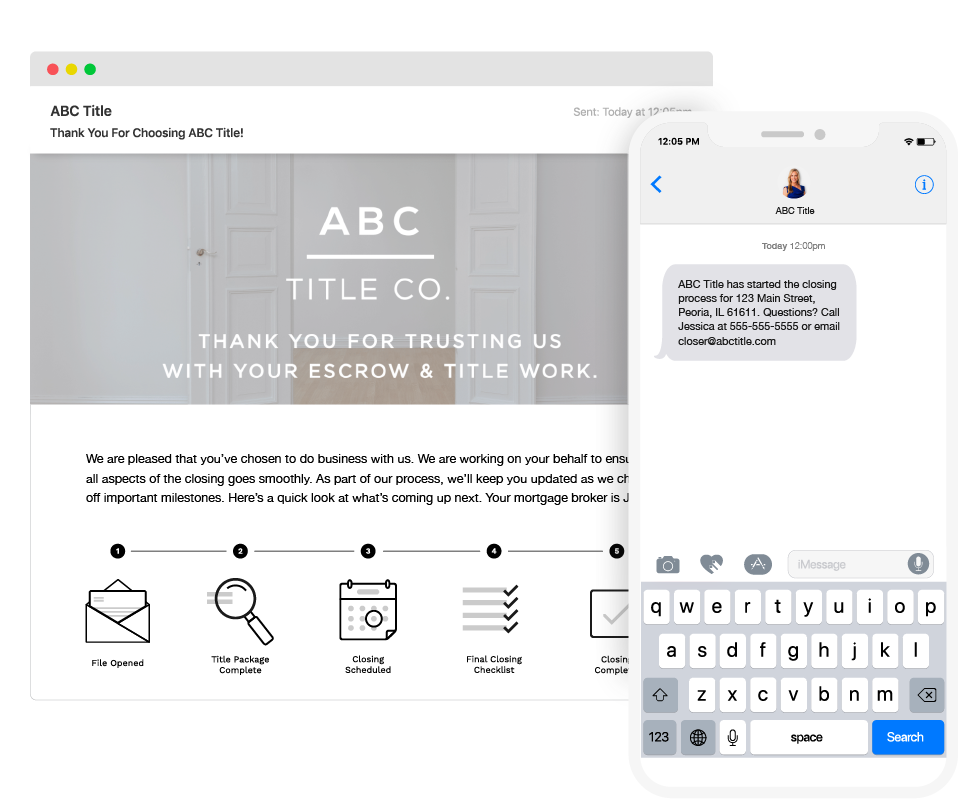

CloseSimple has identified 5 common steps in the closing process and we’ve templated automated updates for each step (including email automation and text message reminders sent directly from your current title production software). These steps and messages are totally customizable, so they fit your company. To read more about these 5-most used templates, you can check out our downloadable pdf.

By using CloseSimple’s automated email and texting during the closing process, you can proactively communicate with realtors and consumers, allowing them to know where they’ve been, where they are, and where they’re going. That gives them control.

The CloseSimple timeline and updates can go a long way to answer your consumers’ questions before they even think to ask them. And, the fact that CloseSimple allows a title company to send emails and text message reminders about the time and place of the closing means there is no guesswork for your client.

Read the full eBook

How 7 non-real estate brands have impacted your customer's expectations on the closing process and what Title & Escrow companies can do to get ahead of the competition by creating a remarkable customer experience.

bogid - 27787114388

Related posts

Article

How the Domino’s Pizza Tracker Changed Consumer Expectations

Article

How Uber Gave Customers Control & Why Title Should Take Notice

Article

Jimmy John’s: Freaky Fast & Impacting How Your Clients View the Closing

.jpg?length=350&name=3_Amazon_CloseSimple_Changing_Land_TitleFeatured%20Image%20for%20Social%20(1).jpg)

Email Efficiency

What Amazon’s Customer Experience Means for the Title & Escrow Industry